Residential Real Estate Rates and Profitability: Mortgage rates were among the highest in the marketplace, yet loan profitability (profit per loan) was behind local and national industry norms. Market share was decreasing due to high daily rates. In addition, rates were often incorrectly calculated and not consistent across all loan officers. Loans were not closed nor delivered in a timely manner due to over promising the customer and loan processing or post-closing delays, often requiring loan extension fees.

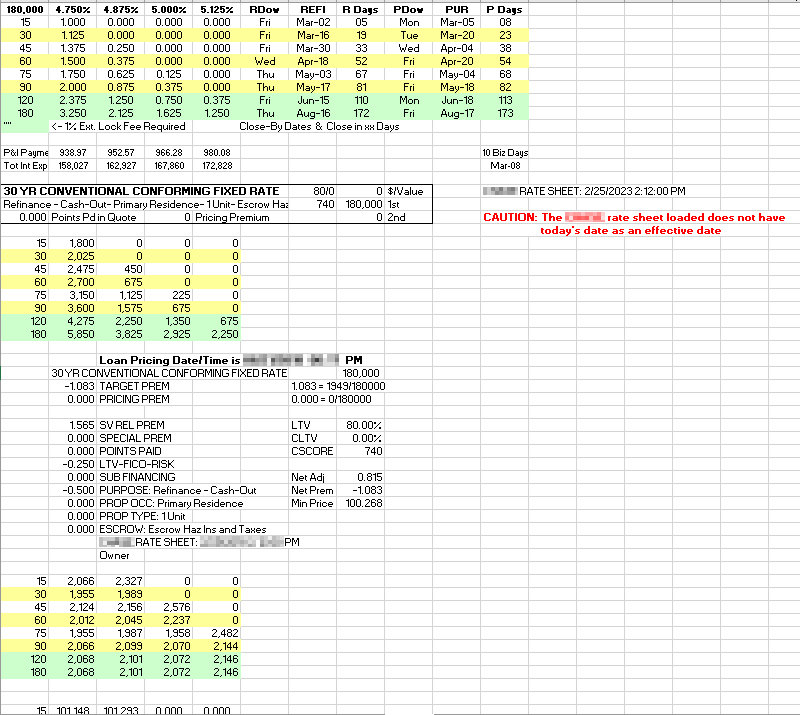

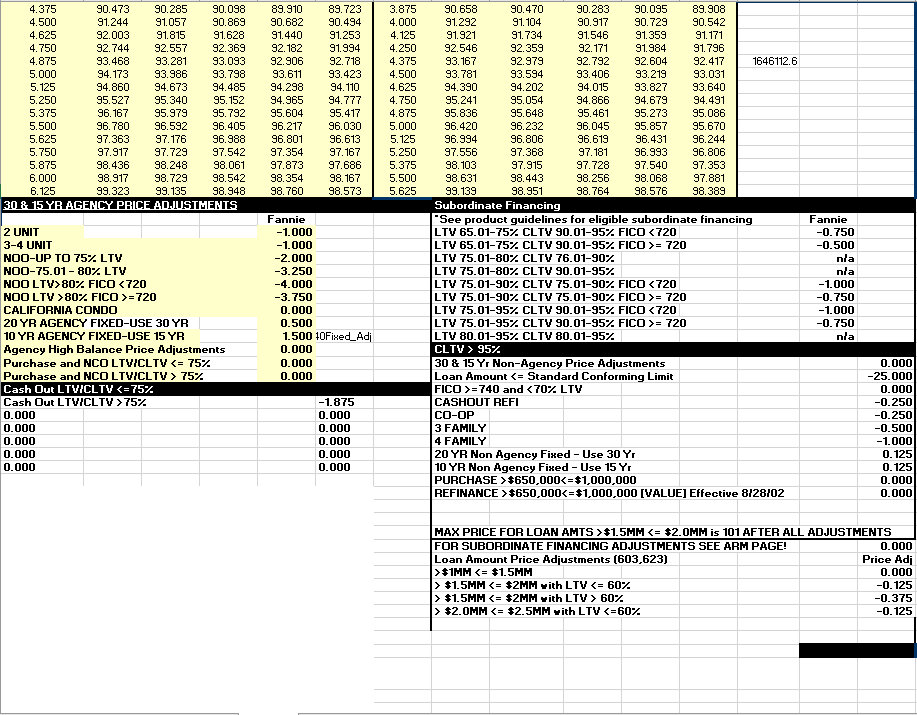

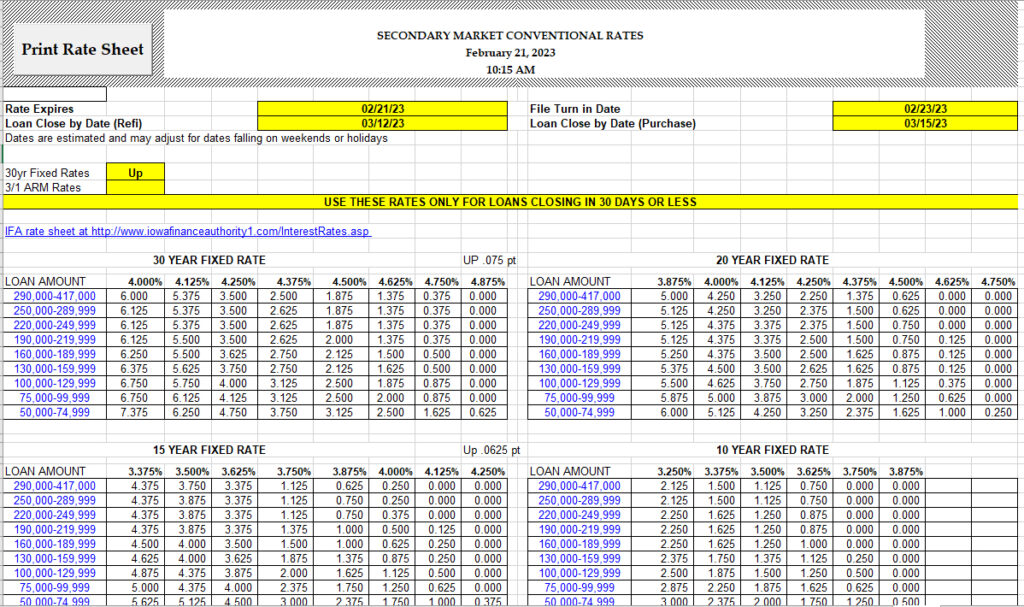

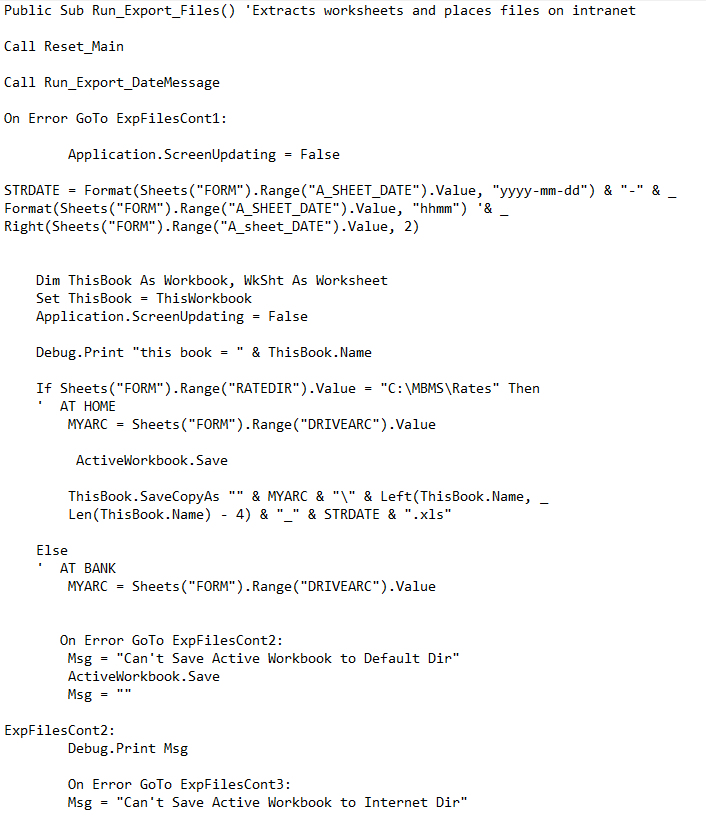

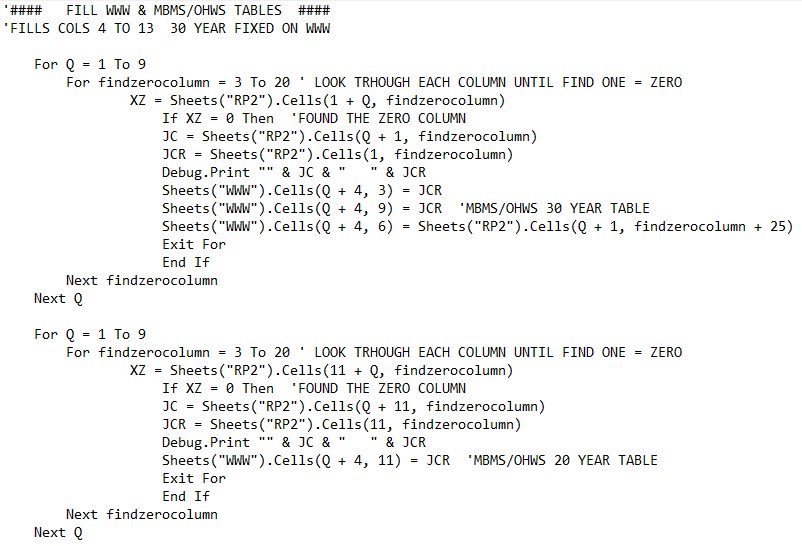

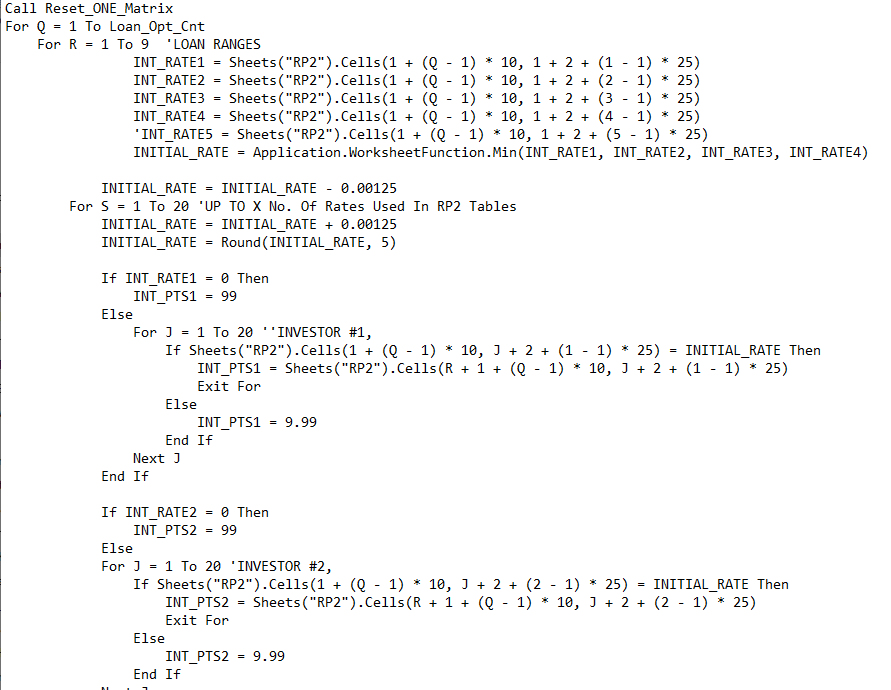

Solution: Studied the competition and their loan pricing. Compared and then added new investors. Developed and Excel VBA application (Pricing Engine) that allowed “side-by side” and “best-case” pricing comparisons for each loan quote from among all investors. Produced daily rates sheets and web files containing the “best-rates” possible among all investors. Loan officers became “price takers” versus “price makers”, and each loan quote was saved to central server directory. Developed and Excel VBA application that calculated close-by dates to close and deliver loans in a timely manner. A mortgage rate hedge policy was created so that loans would float overnight if evidence was “clear” that market rates would drop (become lower) overnight.

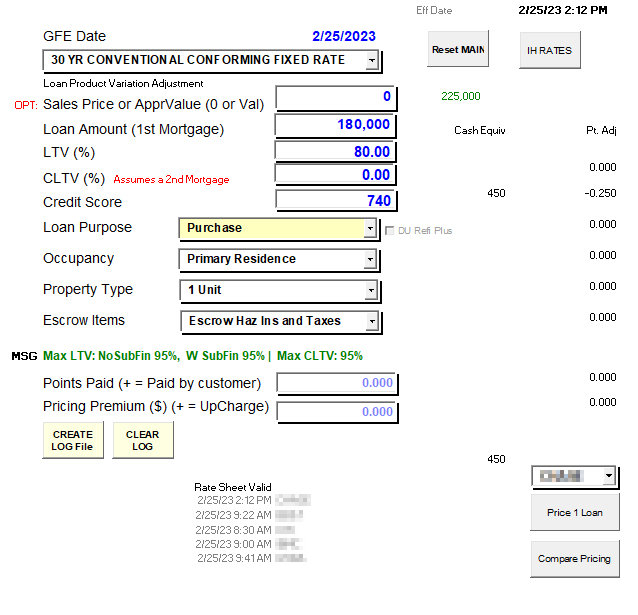

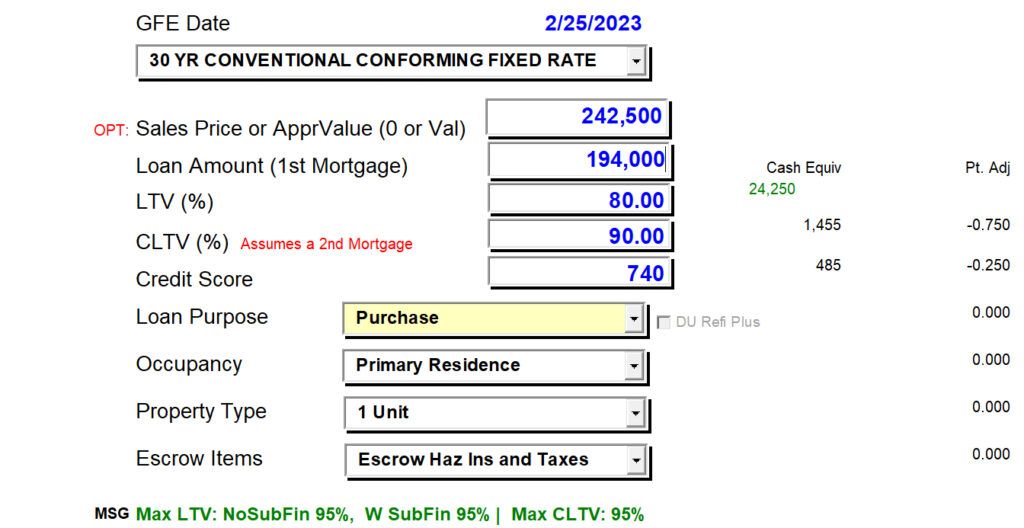

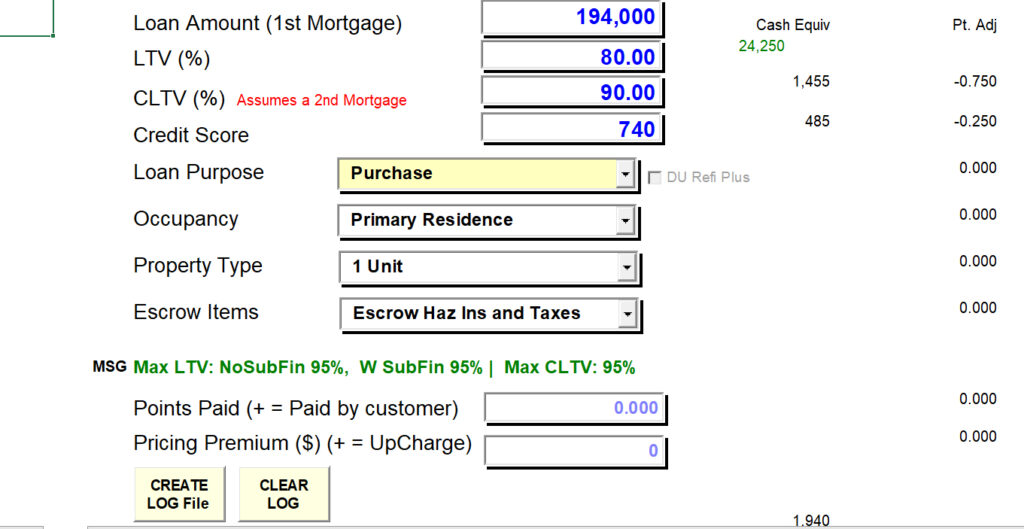

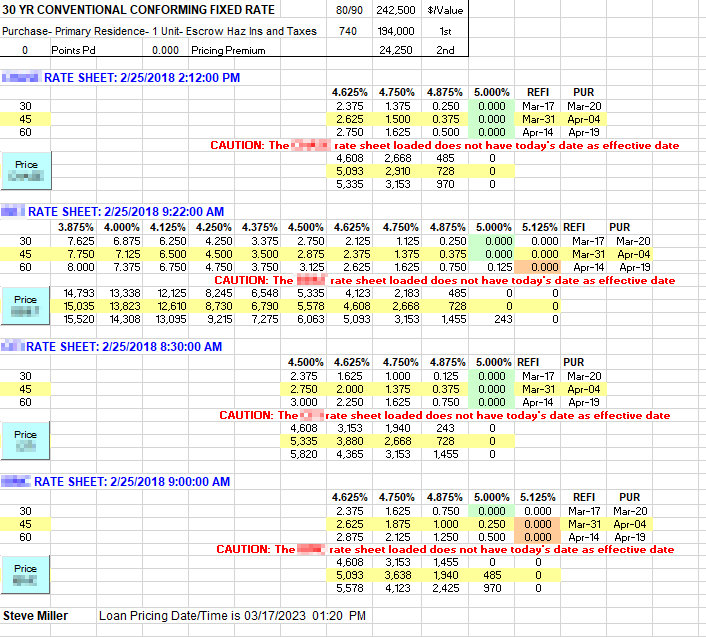

Pricing Engine Notes:

- Loan officers could no longer determine mortgage interest rates on their own. LO’s became price takers, using the Pricing Engine application.

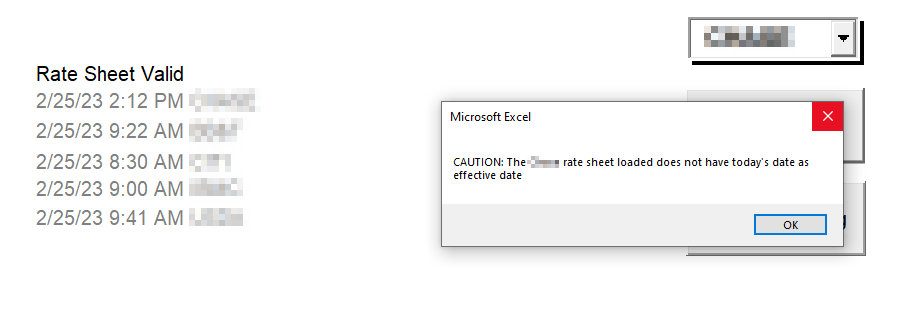

- The Pricing Engine performed an authorized user check and incorporated a “Pricing Effective Date” verification routine to prevent locking loans during a mid-day price change.

- The state and federal auditors were highly impressed because every mortgage quote was saved to a server directory and backed by complete GFE and TIL documentation.

- The loan officer rate quote files were monitored by the sales manager to determine each loan officer activity level

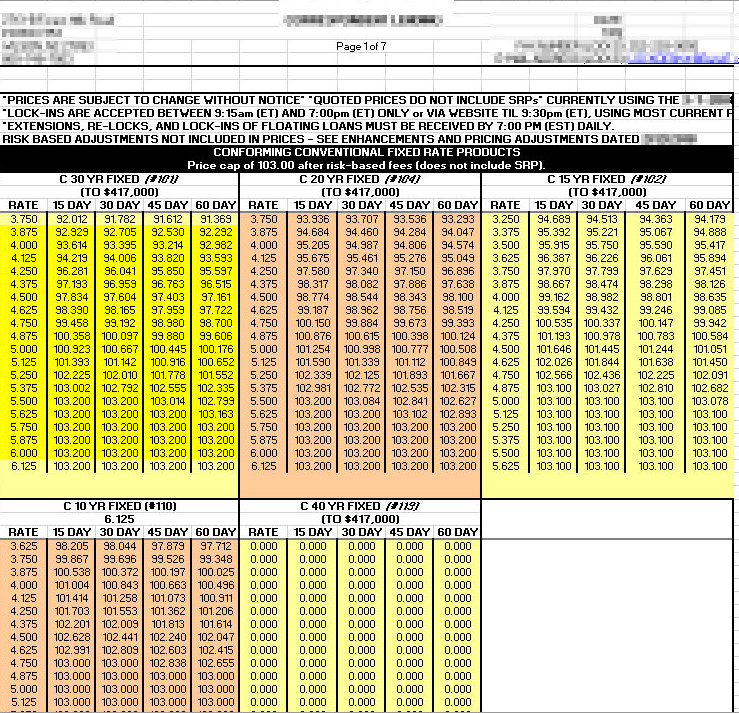

- The Pricing Engine included Conventional Conforming rates, and also In-House rates

- Mortgagebot, an online Real Estate loan application website, was updated by the Pricing Engine.

- Internal and External print media rate sheets were produced automatically by the Pricing Engine.

- New Products were added– ie. EA1, EAII, IFA, IDED, USDA-RD, MCM and LIBOR ARMS.

- The Open House Worksheet program pulled rates from the Pricing Engine based on loan type, program and amounts.

- The competition waited for the release of the bank’s rates each day before publishing their own rates.

Profitability Notes:

- New investors were approved and value tranches were identified automatically by the Pricing Engine.

- Loans were closed on time using the “Close-by” date calculator and every one knew that date from the time of application through closing.

- The Hedge policy allowed for floating loans overnight given the expectation of improved pricing.

- Loan profitability improved by 55 bps.

One investor had problems with their software and as a result of our diligence and thorough review, we approached them about income discrepancies amounting to $60,000. This led to an agreement where an additional 5 bps “sales incentive” was granted from that investor, and amounted to nearly $200K in additional income before the program ended

This VBA project was a “killer application” containing 427 pages of code, 62 worksheets (most of them hidden from users), 3 VBA modules and 1.2 million calculations were made when updating all investor rates each morning. This application used many functions and much coding and used VBA Data Arrays to make calculations quickly behind the scenes reducing the amount of time required to complete the pricing task.